Initial Public Offering (IPO) on the Australian Securities Exchange (ASX) Q&A Sheet

1. Are US companies welcome to list on the ASX?

ASX welcomes foreign companies including US companies to list. There are around 45 plus US companies listed on the ASX to date, with a pipeline of more companies especially in the technology space to come here every year.

2. What are the main requirements for listing on the ASX?

See Appendix 1

3. Are there any requirements re the industry the company’s business is involved in?

Generally, ASX does not impose restrictions on industry. Each IPO will be reviewed on a case-by-case basis in determining the suitability for listing. Technology industry is at this stage favored by the market and ASX has a very positive towards it as well.

4. What are the usual corporate structures involved?

For foreign companies, the “top-hat” structure is normally used. It means to set up an Australian public company as the listing entity, and this entity will “top hat” all the existing foreign entities. This Australian public company acts as a holding company and usually does not operate the main business.

An alternative method is to directly list the foreign entity (eg. a US Delaware company) via CDI. Both mechanisms have been used in the past by BlueMount.

5. What are the capital raising requirements at IPO?

ASX requires a minimum 20% free float at listing, however it favors a higher percentage. The calculation of this minimum of 20% is 25% of the pre-IPO value.For example, an A$100 million pre-IPO value would require a minimum capital raise of A$25 million.

6. Can capital be raised in a foreign jurisdiction for the IPO?

Yes. The capital raising can be carried out outside Australia but will be subject to foreign laws and regulations.

For US companies, raising money in US must comply with relevant SEC requirements. BlueMount can provide detailed information.

7. Who actually raises the capital required?

The capital is usually raised by BlueMount in conjunction with the company, and other advisors / brokers if applicable.

8. What are the requirements on Australian directors of the Australian IPO company?

The Corporations Act requires at least 2 directors to be Australian residents for an Australian public company. These directors should have previous ASX experience as well as corporate governance or industry experience. ASX recommends the majority of the board be independent directors as well as an independent chairman.

9. Are the companies in the corporate group required to be audited and is the auditor required to have a certain status?

Yes. The audited financial statements are compulsory for the listing and the audit report should be unqualified. BlueMount strongly suggests using a big 4 auditor or a top 2nd tier firm due to the requirements of some larger investors who insist on this as a condition of investing. The auditor should be the same firm for all companies in the group.

10. How long does an IPO take to complete?

10 to 12 months is reasonably expected to complete an IPO

11. Can BlueMount recommend all the necessary legal, audit and accounting advisors and what size/status should they be?

Yes, BlueMount can organise the appointment of the IPO team. The team members are usually reputable and well recognized by the market and the ASX.

12. What are the requirements for the number of shareholders for the IPO company?

For a foreign listing at least 300 shareholders, of which 75% (225) must be Australian residents.

13. What escrow requirements for shares will be involved?

For Assets test, the ASX will impose mandatory escrow, which usually, but not in all cases, is 2 years for all pre-IPO shareholders.

For Profit test, there is no mandatory escrow required but it is normal to have voluntary escrow, for all large shareholders

14. Who will coordinate the whole transaction?

BlueMount will coordinate the IPO as the Lead Manager

15. Is the success of the listing guaranteed?

ASX has the total discretion to decide if a company can be listed and therefore no guarantee is available. BlueMount has a track record of listing 5 foreign companies in the past few years. We are confident to bring a successful listing to our client.

16. What’s the average PE of ASX listed companies and specific industries?

The average PE for established ASX listed companies is around 44.3x recently.1 Once we know the industry that the company is in, we will conduct research and provide an average PE for the particular industry.

1 Bloomberg as at 8 January 2021 https://www.bloomberg.com/quote/AS51:INDA new company listing should expect to start with a lower PE and over a period of time increase it to the industry average.

17. Will the IPO be underwritten?

BlueMount, working with the company, will ascertain any underwriting possibility with qualified brokers, and when underwriting is not possible make best endeavors to make sure the listing and capital raising is successful.

18. What are the total cash costs of the IPO?

It depends on the size of the company and the capital raising. Usually, we would suggest allowing approx. US$1.5 million for the cash costs.

19. What are the good fame and character & police checks?

All directors of the IPO company must supply appropriate good fame and character & police checks. The Australian and foreign (eg. US) legal teams will assist with all of that.

20. What are main requirements on the major shareholders?

Details and background of the major shareholders will be required.

21. What are the corporate governance requirements?

Corporate governance has been a major concern to ASX, and the company must agree to adhere to the relevant requirements and demonstrate how they will do so. BlueMount can provide detailed information.

22. What is the purpose of listing?

The ASX has a negative attitude to foreign companies listing purely for reasons of “prestige” and we will need to convince the ASX that the main purposes are to gain liquidity for shareholders, access the Australian capital market, etc.23. What is the revenue needed for the listing?

Revenue is not an official criteria (ie. listing rules) to go public on the ASX. However, it will be difficult to list a company with no or small revenues these days. Profits or Assets are the two main entry methods (Refer to Question 13)

24. What is the post IPO value of shares and public relations?

The company must do everything it can to ensure the shares in the IPO company do not fall below the issue price.

We strongly suggest that the company:

l engage a stockbroker to facilitate buying and selling of the company’s shares and to provide research

l engage a corporate public relations firm to advise on investor relations, roadshows, or similar activities.

25. What are the reporting requirements as a public, listed company?

The reporting requirements for public, listed company can be found in the paper provided by the Australian Institute of Company Directors:

26. Compliance with SEC

An offer and sale of securities must be registered under the U.S. Securities Act of 1933 unless the transaction is exempt from, or not subject to, the registration requirements. Regulation S under the Securities Act provides that offers and sales of securities in “offshore transactions” are not subject to the registration requirements. In order to enable U.S. companies to list on ASX in compliance with Regulation S, the ASX sought and obtained “no action” relief from the U.S. Securities and Exchange Commission (SEC) in 2000. More details can be found in this paper provided by Baker McKenzie:

With numerous growth-stage companies from Australia, the Asia-Pacific, the US, Europe and Israel successfully listing on the ASX with good valuations and traction for scale, a clear trend has emerged – the ASX is increasingly being used by companies as either a steppingstone to a future dual listing on other exchanges or as a long-term listing venue.

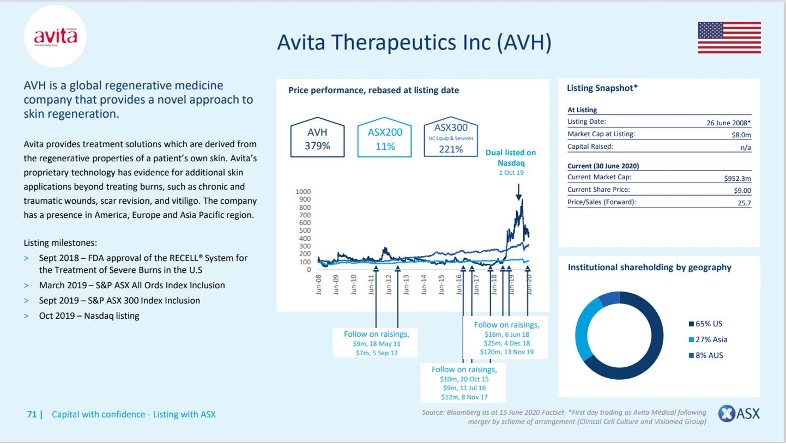

A great example is Avita Therapeutics Inc (Initially listed on ASX in 2008, at a value of A$8 million, dual listed on NASDAQ in Oct 2019, now has an A$1.3 billion / US$952 million market cap).

Appendix 1

| Spread | Minimum 300 non-affiliated investors @ A$2,000 |

| Free Float |

The free float is a minimum of 20% and represents the capital to be raised at IPO.

The calculation of this is 25% of the pre-IPO value. For example, an A$100 million pre-IPO value would require a minimum capital raise of A$25 million. The free float:

|

| Profit test entry requirements | A$1 million aggregated profit from continuing operations over past 3 full financial years; and A$500,000 consolidated profit from continuing operations over the last 12 months before admission |

| OR | |

| Assets test entry requirements | A$4 million net tangible assets after IPO expenses; or A$15 million market capitalisation |