Renewable Energy Group Appoints BlueMount Capital For US$50m Debt Raising

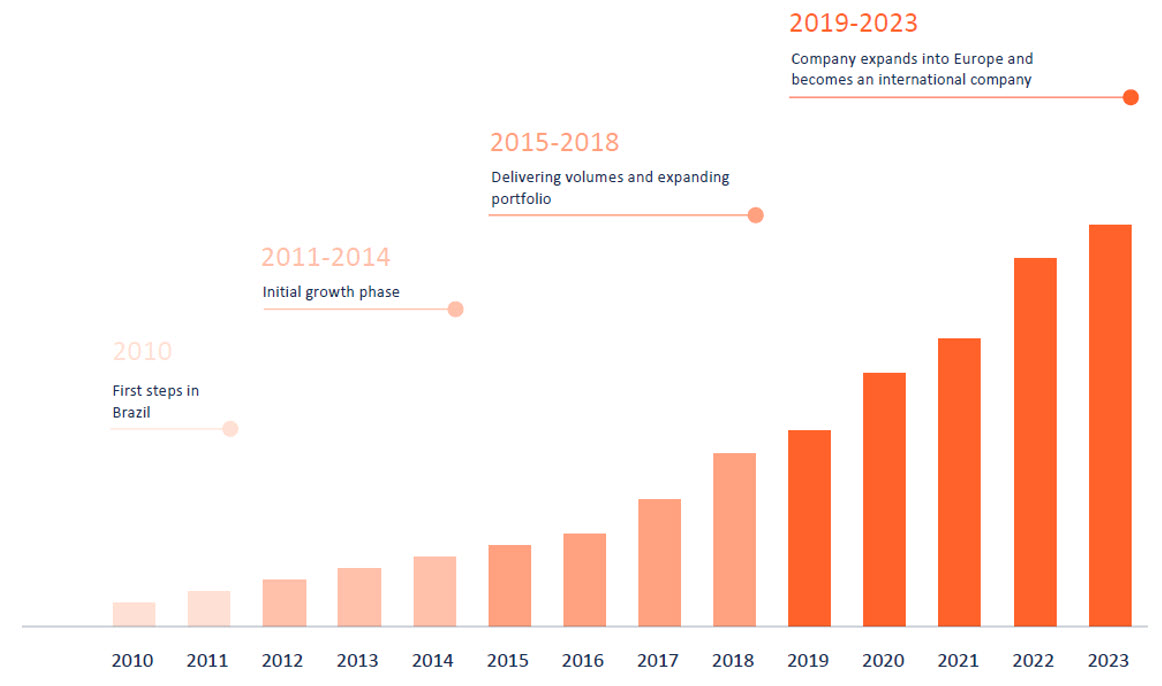

BlueMount Capital introduces Project Energy (“Company”) – a UK Limited Company focusing on renewable energy infrastructure and operations, with current core markets in Brazil and Europe, and expanding into the USA, and throughout UK and Europe.

As an independent power producer (IPP), Project Energy’s model is to develop, finance, construct and manage a portfolio of utility-scale and distributed energy assets. Project Energy develops its sites from conception, ensuring a complete end-to-end solution. The Company now has an extensive in-house EPC (Engineering Procurement and Construction) capability which allows control of the entire development process, from greenfield conception, through development, construction, and operation.

A strong team of professionals spanning electrical and civil engineering, project development, environmental licensing, purchasing, construction, administration, and finance, ensures the Company’s core team is established, has the track record, and is ready to undertake the next step in becoming an IPP. The business is highly scalable within its core markets, in addition to other solar energy markets with similar synergies, and in complementary renewable technologies. Project Energy has achieved success by developing its solar PV assets to reach Ready to Build (RTB) project status.

The Company is developing floating offshore wind projects for the UK’s Celtic Sea round, and will be bidding in the upcoming Portuguese, Spanish and Brazilian rounds. The Company is in discussions with several Japanese corporations to invest in the offshore subsidiary.

Project Energy has developed an Asset Portfolio of 4.5GW and a very strong PPA (Power Purchasing Agreements)/offtake network with several global energy and strategic entities. These PPAs typically have 12-year duration, price indexation, and 30% termination penalties in favor of Project Energy.

Asset Value

Project Energy engaged Deloitte to undertake a fair market valuation of its assets. As of 30th March 2022, the estimated asset valuation was €122.5m. While the valuation at 31st March 2023 is not yet finalised, it is expected to be closer to €215m. Project Energy reported audited Net Assets of £103m at 31st March 2022.

Financials

Reported Operating Revenue at the Group level of £3m for 12-months to 31st March 2022 (£1.2m for the 12-months to 31st February 2021).

Revenue from the Brazilian solar PV plants starts to come in during Q3 2023, rising significantly during 2024. Upon completion of the acquisition of the Portuguese EPC, revenues and cash position will be highly accretive.

Management forecasts are as follows:

| FORECAST | 2023 | 2024 | 2025 |

| Revenue | USD$24.7m | $84.5m | $78.9m |

| Net Cashflow | USD$20.9m | $26.3m | $36.5m |

For more information, please contact Len McDowall by phone on +61 2 9238 4209 or email sydney@bluemountcapital.com