Supercharging your bond or sukuk issuance

Equity and debt markets are becoming more challenging as we enter Q4 in 2022. Central banks around the world are targeting inflation by successively increasing interest rates. The dynamics are for more expensive equity and debt. Issuers that can delay capital raisings will do so, however for corporations that must raise funds, the landscape may be more competitive, and they will need to have a compelling case.

There are several advantages of a bond financing over mezzanine financing, including the potential to attract international institutional investors and family offices, and the potential to access these investors in new raisings, and listing the bonds on international stock exchanges.

For Australian middle market issuers, it will be critical that they enhance the prospects of their issuance. Some of the ways they can supercharge their fixed income issues can include some or all the following:

- Incorporate a credit rating from one the three top tier agencies. Whilst this is expensive, a credit rating will expand the universe of investors to include most institutional investors that require a credit rating from a top three firm,

- A credit rating also allows the market to price your bond or sukuk, or at least helps the issuer and their advisors to price their issues more accurately,

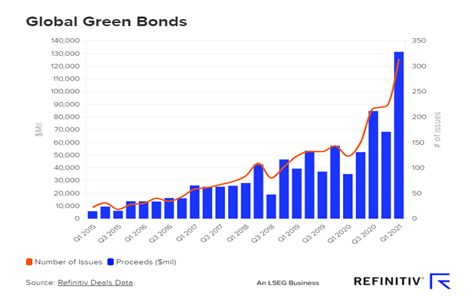

- Judiciously use a Green Second Opinion, sometimes referred to as a Green Rating. Again, a recognised second opinion firm should be appointed. A Green Second Opinion will be attractive to a broader investor base in Australia and offshore. The graph below of the primary market issuance of global green bonds shows a clear trend that we believe will continue to trend upwards.

- Where applicable, an issuer should look at their ESG policies, and/or the UN Sustainable Development Goals (SDGS). This will become the norm for issuers rather than a discretionary policy by issuers,

- Issuers may also look at issuing Impact Bonds and use an expert firm in the field to develop their impact targets and to report on the progress of these.

For more information on the issuance of green, ESG, and impact bonds and sukuk, please contact perth@bluemountcapital.com, saliba.sassine@bluemountcapital.com or on +61 (0) 412533966.